Track Record

We are proud of our track record of accurately forecasting major developments in the Chinese economy, including the performance of Chinese equities, the Yuan vs. Dollar and the dynamics of US-China relations. Our insights have consistently provided our clients valuable guidance in these critical areas. Please click the tabs below for more detail.

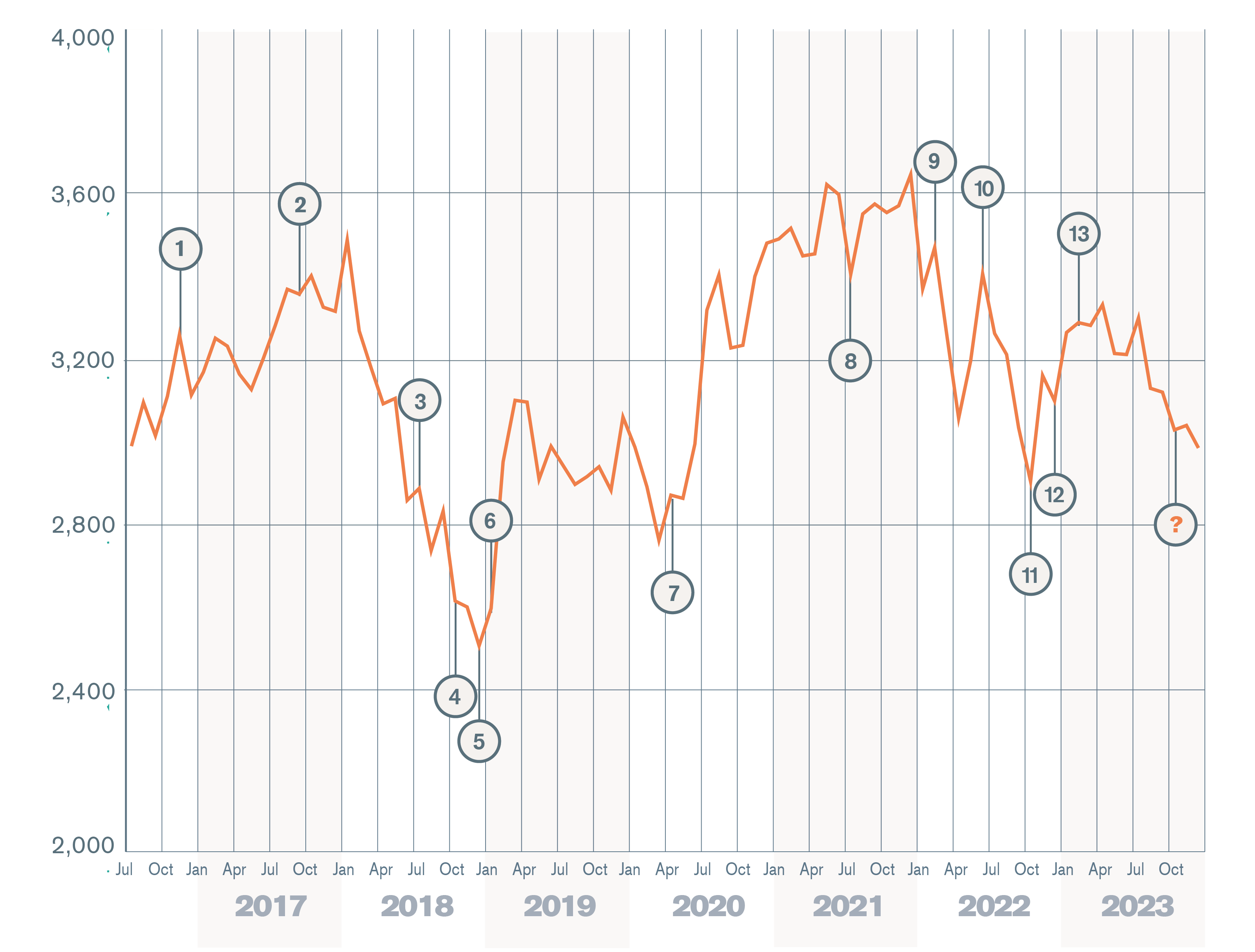

13

Investors are stuck between a rock and a hard place. Monetary and liquidity developments favour Chinese equities, but Xi remains wedded to an economic model which gives the Party ultimate control over every aspect of the economy.

Feb 2023

12

We advise long-term investors to sell into any equity market upswing. We believe the Great Decoupling is unlikely to reverse, and that Xi's economic policies have pushed China into a slow-motion crisis of the real economy.

Dec 2022

11

Bearish outlook for China equities for the short term; Warming US-China relations or changes in zero-Covid could improve prospects.

Oct 2022

10

As China learns to live with Covid, the focus of Xi’s efforts to revive the economy in the short term will be on investment-led growth. That means old-style equity plays are likely to outperform bets on China’s big tech firms.

Jun 2022

9

We expect Beijing to start easing policy more forcefully within the next few months, which is likely to reinforce the views of those China bulls. This may present an opportunity for nimble hedge funds, but at this stage we would not advise a major reweighting towards Chinese shares for other managers.

Feb 2022

8

Consequently, this should be read as bad news for commodities, related currencies and China’s equity market, with any rise offering a selling opportunity.

Jul 2021

7

A-shares might beat other major markets once again in Q2; But long-term investing in Chinese equities is not a good idea.

Apr 2020

6

Any A-share upswing as Beijing's stimulus unfolds in H1 would be a selling opportunity.

Jan 2019

5

From a long-term perspective our advice is to sell into any equity relief rally and to stay away from both Chinese stocks and bonds.

Dec 2018

4

A jump in corporate bond defaults, bank NPLs and debt write-offs could well spook an already jumpy equity market and cause further financial market volatility.

Oct 2018

3

What is more worrying about the trade war for now is that it is undermining both consumer and corporate confidence and contributing to the sharp fall in the equity market, making Beijing’s de-leveraging that much harder.

Jul 2018

2

The rally could well continue in coming months as excess liquidity is yet again dammed up inside China courtesy of tighter capital controls. But our analysis and arguments suggest that now is not the time to make a long-term investment in either Chinese equities or bonds.

Sep 2017

1

If the market perceives China’s financial reforms as achievable and credible, even sentiment toward the equity market could turn positive.

Nov 2016

Access Enodo’s analysis and forecasts by requesting a TRIAL and make your next big move:

Your privacy: All information will be collected and stored for the purpose of providing you with information about, and delivery of, our services. Click here to see our privacy policy.

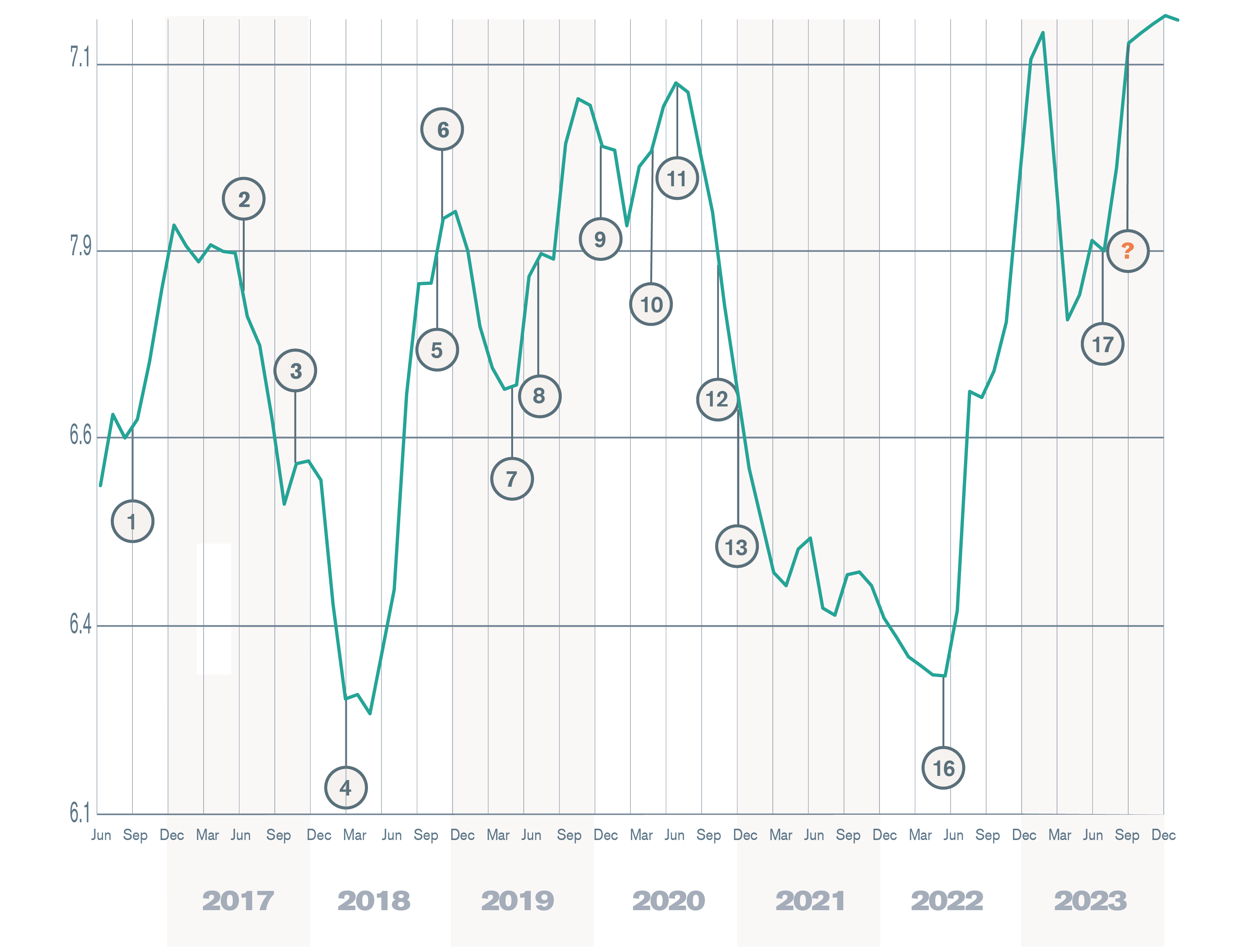

17

The economy is in the clutches of a debt-deflation spiral that will necessitate a weaker yuan to cushion the adjustment.

Jul 2023

16

China will defend the yuan and has the ammunition to do so for now...yuan to weaken in the long run.

Apr 2022

15

We expect the yuan to stay stable or on a mild strengthening trend against the dollar for the rest of the year...But the yuan’s fate could change drastically in 2022 as deleveraging, decoupling and redistribution enfeeble China’s economy.

Sep 2021

14

Yuan to stay on mild strengthening trend vs dollar in H2.

July 2021

13

Come next July, the renminbi is likely to be worth closer to 6 to the dollar than 7.

Dec 2020

12

A stronger yuan is in China’s interest now as we have argued over the course of this year.

Oct 2020

11

The yuan is set to stay stable or appreciate slightly against the dollar.

May 2020

10

We change our view: virus means yuan no longer set to fall in 2020…a stable or slightly appreciating yuan.

March 2020

9

The yuan is likely to depreciate sharply against the dollar over the next 12-24 months.

Nov 2019

8

Yuan to fall without productivity boost.

June 2019

7

We expect the yuan to be broadly stable in the next couple of quarters, but we are watching the currency closely as it remains the principal pressure release valve for the economy as it changes.

Apr 2019

6

I expect the yuan/dollar rate to move within a range of 3-5% over the next six months, with depreciation more likely than appreciation.

Oct 2018

5

We do not expect a 10-20% devaluation from current levels over the next 6 months.

Sept 2018

4

This is a potent mix, arguing for a shift in exchange rate policy...Investors would be well advised to pay close attention to the yuan this year.

March 2018

3

Renminbi bulls should enjoy this year’s rally against the dollar while they can.

Oct 2017

2

Restraining illegal capital outflows will prop up the currency and help China for a bit...Yuan’s correction more likely in 2018 than 2017.

June 2017

1

Expect more currency market volatility and more decisive action to allow the yuan to regain competitiveness after November.

Sept 2016

Access Enodo’s analysis and forecasts by requesting a TRIAL and make your next big move:

Your privacy: All information will be collected and stored for the purpose of providing you with information about, and delivery of, our services. Click here to see our privacy policy.

Enodo Economics pioneered the analysis of the Great Decoupling- the bifurcation of the global economy into a US and Chinese sphere of influence as the existing and aspiring hegemon battle for global supremacy.

10-Nov-2016

The Beginning of the End

"The world has failed to make globalisation work, causing tectonic economic and political shifts. With a dangerously clueless Donald Trump now headed for the White House...

and an all-powerful and determined Xi Jinping at China’s helm, the global political order will change beyond recognition. While political uncertainty will abound, Trump’s election puts the world economy firmly on course to reverse the free movement of goods, capital and people that we have known over the past few decades."

11-Jan-2018

China’s Trump Trade Headache to Intensify in 2018

"Trump’s honeymoon with Xi is over, pointing to a much more strained relationship during 2018. America is reconsidering its China strategy, although it is far from clear whether this has...

been well thought through. China is actively working to reduce its co-dependency on the US but is not ready to stand up to Washington. Beijing’s response to any US trade action is likely to be confined to damage limitation. But any accommodation from China in the upcoming trade skirmishes will only provide a temporary respite from an eventual full-blown trade war."

12-Apr-2018

Xi Jinping, The Man and His Politics

"There is ample evidence in what Xi has said and done to suggest that he believes it falls upon him as China’s current leader to bring Taiwan back to the fold. He is just waiting for the opportune moment."

20-Sep-2018

Key Investment Themes: The Digital Cold War Threat

"The trade war is part of a broader geopolitical confrontation that is not going away any time soon. The new Digital Cold War implies much higher equity risk premiums over the next 2-3 years....

The likely break-up of supply chains is bad news for global businesses. De-globalisation threatens cost-push inflation in the next 3-5 years."

13-Dec-2018

Key Investment Themes: From Trade War to Tech War

"2019 is likely to see Washington intensify efforts to contain China’s tech firms, enlisting other countries in its campaign. A tech war, even if there is progress in resolving...

the trade clash with the US, is likely to dampen investor sentiment in 2019. From the macroeconomic and geopolitical perspective, long-term sector and firm analysis must be carried out within the framework of de-globalisation. Breaking up and re-routing existing supply chains points to cost-push inflation – bad news for bonds and stocks. The world is likely to bifurcate into competing American and Chinese spheres of influence.”

01-Jan-2019

The Great Decoupling 2019-2024: Taiwan War Timeline and War Over Taiwan Is Inevitable

Enodo Economics starts regular assessment of the probability of military conflict over Taiwan or the South China Sea on a 3-5 year horizon, placing it at 10% in January 2019.

12-Sep-2019

The Great Decoupling: Capital Markets War

"Just as China is throwing the doors of its financial sector and capital markets wide open after 20 years of lobbying, the growing stand-off between the US and China means foreign...

investors might need to plan for a fast exit. Such are the potential ramifications of the great decoupling between the two countries that is now underway. After Washington’s launch of trade and tech wars against Beijing, a new front is forming – this time in the capital markets."

07-Jul-2020

The Great Decoupling: China’s Fading Appeal as an Export Platform Set to Lift US Reshoring

"New Enodo Reshoring Index shows tech, pharma and cars are the most likley sectors under pressure to reshore to the US."

01-Sep-2020

Don’t Dive for Cover Yet…but Update Your Evacuation Plan

Enodo Economics launches a specialised service focused on Taiwan, which continuously monitors and analyses the risk of accidental or intentional military conflict over Taiwan on a 3-6 month horizon.

01-Jan-2021

Taiwan: The US-China Lightning Rod That Investors Cannot Ignore

"While a direct assault cannot be ruled out, it is more likely that Beijing will resort in the first instance to coercion short of war. Even if China does not launch...

a direct assault on Taiwan there is growing potential for conflict to be sparked by a relatively minor incident. Taiwan is no longer a niche issue for specialists but an issue of growing concern for investors, the international business community and humanity more broadly."

11-Feb-2021

China and the Great Decoupling: Biden’s Big Challenge

"Geopolitical risk will mutate under Biden and likely increase. It's critical for investors to understand and factor it in. The US will keep confronting China over...

trade, tech, Taiwan. The chances of a workable Sino-US modus vivendi are remote. Biden’s China team is competent, experienced and cohesive."

01-Apr-2021

Doing Without the Dollar: What China’s Plans Mean for Investors

"The Party has patiently been laying the groundwork to advance the international use of its currency. Their plan has now begun to take shape. For China, reducing...

its dependence on the dollar is critical but the substantial progress it has made in building the financial infrastructure it needs to do so has largely gone by unnoticed. If the Party succeeds in establishing the renminbi as a rival reserve currency, the geopolitical, economic and market consequences would be momentous."

31-Aug-2021

Fire and Brimstone Follow Pelosi, but What About Military Changes?

"And while it is clear that China and the US are anxious to avoid direct conflict, there is nothing that points to an improvement in relations and much that...

points in the opposite direction, especially in the form of recent and pending US Congressional legislation. The Pelosi visit will have reinforced perceptions in Beijing that US policy towards Taiwan is changing and that the One-China policy is being progressively undermined."

08-Sep-2022

China's Quest for Financial Self-reliance: How Beijing Plans to Decouple from the Dollar-based Global Trading and Financial System

"Beijing is challenging the privileged status of the Almighty Dollar, as it tries to carve out its own sphere of influence free of Uncle Sam. Enodo's comprehensive...

200-page report explores China’s plans to reconfigure the global financial order, analyzing whether it can decouple from the dollar and create a parallel system based on the yuan. The report lays out China’s strategy, assesses its chances of success, and proposes steps US policymakers should take to safeguard America’s financial system."

13-Apr-2023

No Hiding Place in US Tech War on China

"That the Biden administration’s technology strategy has hit China hard is evident from the reactions of senior Chinese officials. As US sanctions prompt Western...

firms to beware of doing business with China, globalisation and innovation risk being the collateral damage. Next US targets may be quantum computing, biopharma. On the upside, a renaissance in US manufacturing is unfolding, nurtured by massive government aid for advanced chip production and for the development of renewable energy."

30-Jun-2023

Shotguns for the Jackals

"Both sides needed a tactical pause and although China continues to believe that the US is in decline, it has had to confront the reality of a US that has had greater than expected success in building coalitions to constrain China’s regional and global ambitions. ...

But in the face of impending US actions that include further limits on technology exports to and investment in China and continuing military support for Taiwan, the prospects of further deterioration in relations is real. And China will be well aware that in US defence and security circles the talk is now of war with China as inevitable."

But in the face of impending US actions that include further limits on technology exports to and investment in China and continuing military support for Taiwan, the prospects of further deterioration in relations is real. And China will be well aware that in US defence and security circles the talk is now of war with China as inevitable."

10-Jul-2023

Xi Jinping’s Diplomatic Goals Stumble Over Lacklustre Economy

"Under Xi, China is now trying to push the US out of Asia. But its leaders seem to be aware that ambitions to transform the country’s industrial and financial structure and set the international agenda still require that international capital. ...

The result is the current ineffectual hybrid policy of trying to pull in foreign capital while locking out foreign influence. The strategy will be more difficult to pull off without the sweetener of fabulous profits in a rapidly growing economy."

The result is the current ineffectual hybrid policy of trying to pull in foreign capital while locking out foreign influence. The strategy will be more difficult to pull off without the sweetener of fabulous profits in a rapidly growing economy."

06-Sep-2023

Economic Missteps Undermine China’s Geopolitical Outreach

"With Chinese de-coupling not fully off the ground, Xi may have no choice but to restore China’s economic appeal, before resuming attempts to put a rising East – led by China – back in the global driver’s seat."

29-Sep-2023

Beijing Lobs Sticks and Carrots at Taiwan

"The intensification of China’s carrot-and-stick strategy towards Taiwan is unlikely to substantially influence voting decisions in the forthcoming presidential election in China’s favour. ...

But China will continue and likely intensify its efforts over the coming months.

It remains to be seen whether a summit between Biden and Xi will take place or have a significant impact on currently strained relations. But it may be that economic pressures and the impact of the US technology ban will incentivise Xi to seek a tactical reduction in tensions. It will, however, be no more than that."

It remains to be seen whether a summit between Biden and Xi will take place or have a significant impact on currently strained relations. But it may be that economic pressures and the impact of the US technology ban will incentivise Xi to seek a tactical reduction in tensions. It will, however, be no more than that."

➤

Access Enodo’s analysis and forecasts by requesting a TRIAL and make your next big move:

Your privacy: All information will be collected and stored for the purpose of providing you with information about, and delivery of, our services. Click here to see our privacy policy.

What will you have access to during your trial?

Simple, everything.

Simple, everything.

- Enodo Insight: Regular reports that will help you navigate China’s economic, financial market, political and geopolitical developments. Giving you the insight to help you make better investment, business and policy decisions wherever you are in the world.

- Enodo Untangled: Deep-dive analysis of China, providing you with big picture strategic advice on its economic, financial and political outlook and the implications for the rest of the world.

- Enodo QuickTake: A short update to a view or our quick reaction to a topical event.

- Enodo Webinars: Client webinars where Diana Choyleva will present her current views and answer questions. Plus exclusive events where topical themes will be discussed with special guests.

- Enodo Taiwan Watch: Our specialised service will help you understand the ever-evolving risk of Chinese military action against Taiwan and potential US involvement.

- Enodo China in Charts: A chart-based publication where we present our economic and financial forecasts for the coming 12-18 months.

Our analytical tools will also be at your disposal.

- Enodo Chart Library: You will have full access to our Chart Library. Here, you will find every chart we have ever used, arranged by theme and always up to date.

- Data Download: Download the data from any of our charts to use in your own analysis or presentations.

- Enodo Infographics: Complex analysis delivered to you in easy to follow infographics.